Account settings

-

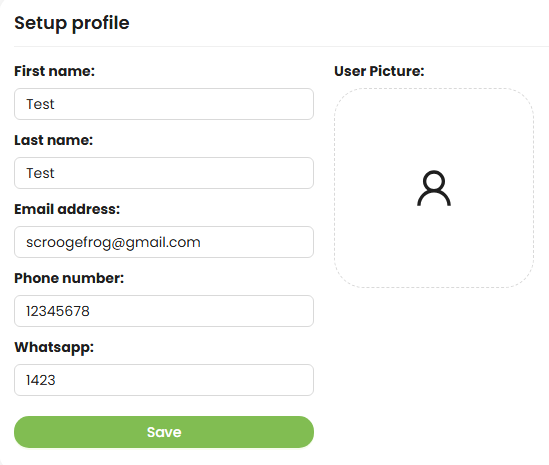

The Personal data section allows you to manage your personal or company contact details. This information is essential for receiving important notifications about your account — such as system updates, traffic limits, billing, subscription renewals, and other service-related alerts.

What information can I provide in this section?

You can fill in the following fields:

- First Name and Last Name – used for personalizing communication.

- Email Address – this is the main email we’ll use to send you alerts, confirmations, and important updates.

- Phone Number– may be used for urgent communication or identity verification.

- WhatsApp – optional, used for faster communication or support if needed.

- User Picture – uploading a profile picture helps personalize your account, especially for team collaboration or multi-user dashboards.

Note: All personal information you provide is securely stored and used solely for account-related communication.

Make sure this section is always up-to-date to ensure you never miss critical updates or service notifications.

-

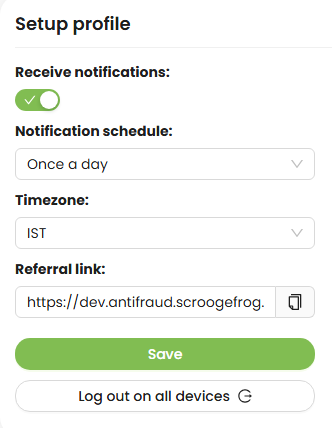

The Total data section allows you to manage your account-wide preferences for notifications, location settings, and referral program access.

Here’s what you can do in this section:

- Enable or disable notifications.

Toggle the Receive notifications switch to turn email or in-app alerts on or off. If notifications are disabled, you won’t receive any updates about your account status, traffic limits, reports, or system alerts.

- Choose Notification Frequency.

Under Notifications periodicity, you can select how often you'd like to receive updates. Options may include real-time, once a day, once a week, etc. Choose the frequency that best fits your workflow and alert preferences.

- Set Your Timezone (Geo).

In the Timezone dropdown, select your preferred timezone. This helps align system time, reporting, and AI-based calculations (such as traffic analytics or fraud patterns) to your local time, ensuring more accurate insights.

- Referral Program Access.

The Referral link field gives you a personal invitation link that you can share with partners or colleagues. When someone signs up through your link, you may earn bonuses or credits depending on our referral program terms.

- Log out of all devices.

Clicking Log out on all devices will instantly terminate your active sessions on every device — useful if you think your account was accessed from an unknown location or for additional security.

Make sure to hit Save after any changes to keep your settings updated.

- Enable or disable notifications.

-

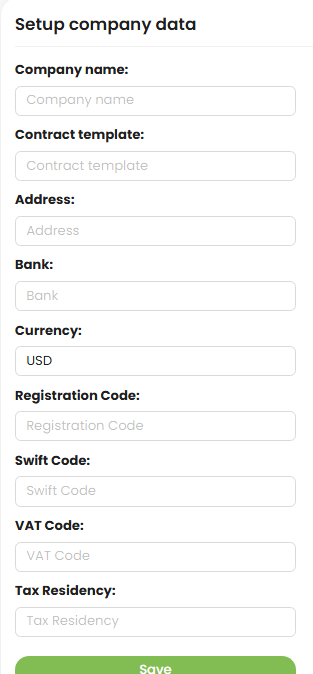

The Organization Data section is where you provide your company's official details required for contracts, invoicing, and regulatory compliance. This information is securely stored and used strictly for billing and legal documentation purposes — we do not share it with third parties.

Here’s what you’ll need to fill out:

- Company Name

The full legal name of your business entity. Make sure it matches official registration documents.

- Contract Template

Select or upload the contract template that should be used for agreements with our service. This ensures smooth legal and billing operations.

- Address

Provide your company’s registered legal address, including street, city, ZIP/postal code, and country.

- Bank

The official name of your company’s banking institution — used for invoicing and payment coordination.

- Currency

Select the currency in which you'd prefer to receive or make payments (e.g., USD, EUR, etc.).

- Registration Code

Enter your company’s national or state business registration number (sometimes referred to as a business ID or company code).

- SWIFT Code

This is the international bank identifier used for cross-border payments. You can get this from your bank.

- VAT Code

If your business is VAT-registered, include the VAT number here. This is especially important for companies operating in the EU or UK.

- Tax Residency

Specify the country where your business is officially registered for tax purposes. This helps us comply with international tax reporting regulations.

Make sure all data is accurate and up to date — it affects how contracts are generated and invoices are issued.

- Company Name